Henrico aims to boost access to homeownership with $60 million fund

Henrico County has set the framework for its Affordable Housing Trust Fund program as an initial set of residential developments are under review for participation.

After announcing its plans in May, the Board of Supervisors established the trust fund, effective July 1, with $60 million in previously unbudgeted revenues from data centers.

The fund aims to help working adults – such as health and child care workers, paralegals, teachers and others – become homeowners by bridging the gap between what they can afford and prevailing home prices, which have soared in recent years due to strong demand and elevated interest rates.

Officials hope to eventually have as many as 100 to 150 new homes per year sold through the program as awareness grows.

“We’re excited about the trust fund launching, and it seems like prospective homebuyers and the builder/developer community are equally excited about the program as we are,” Department of Community Revitalization Director Eric Leabough said.

The nonprofit Partnership for Housing Affordability, which is administering the program, began accepting project applications in September. Two are currently under review, with another submission expected.

Officials with the county and nonprofit spent recent months fleshing out many of the program’s details, including the qualifying criteria for homebuyers and new residential developments.

In most cases, the trust fund is expected to reimburse builders and developers for eligible costs for land and other expenses associated with the construction of the new units – single-family homes, townhouses and condominiums – that are approved for the program, Leabough said.

“We’re helping them reduce the sales price to the buyer,” he said.

The program is equipped to further limit a homebuyer’s costs through a waiver of county fees for utility hookups and permits. Qualifying developments also will receive an expedited review of plans.

The trust fund strengthens Henrico’s earlier efforts to boost opportunities for affordable homeownership, and it’s designed to be implemented countywide, with participating dwellings dispersed in new communities alongside and indistinguishable from market-rate homes. One of the requirements is that the dwellings must be “architecturally compatible” with surrounding homes.

To ensure the program meets its goals for affordability, all qualifying dwellings must be owner-occupied, and each lot will carry deed restrictions for at least 10 years, even if it’s resold. During that period, any new buyer would have to meet the same qualifications as the original purchaser.

“Every home will have at least a 10-year affordability period,” Leabough said.

To have a development qualify for funding, a builder or developer must enter into an agreement with the Partnership for Housing Affordability that establishes a maximum sales price for the participating dwellings and the income limits of eligible buyers.

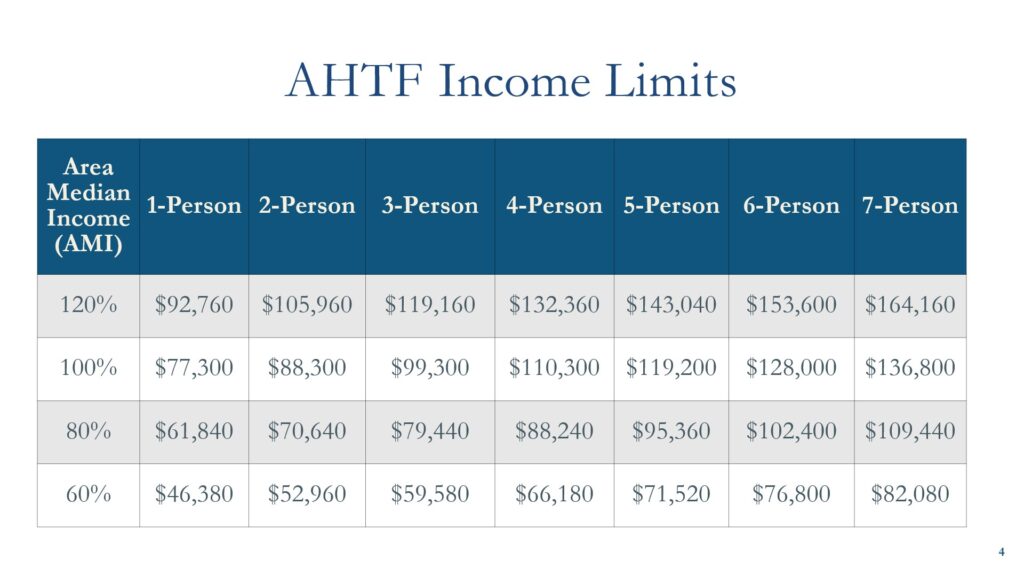

The program is designed for individuals with household incomes between 60% and 120% of the area median income, as defined by the U.S. Department of Housing and Urban Development. For example, that means incomes of $52,960 to $105,960 for a two-person household and $66,180 to $132,360 for a four-person household.

The affordable housing program also will consider price variations in the local housing market by setting a home’s maximum sales price by ZIP code in line with sales data.

For example, a three-bedroom home in Glen Allen normally listing for $589,375 could carry a maximum price of $370,100 for a buyer qualifying at 120% of the area median income. Comparably, a three-bedroom home in Highland Springs normally listed at $255,750 could sell for $229,100 to a buyer qualifying at 80% of the area median income.

For more information on the Affordable Housing Trust Fund or to apply as a builder or developer, visit pharva.com/henrico-trust-fund/. The Partnership for Housing Affordability is developing a portal that will connect prospective homebuyers with qualifying developers and builders.