Henrico County’s budget process involves reviews of current County finances, local and regional economic conditions, major program changes, and wage and price levels. The review of current County finances covers such specifics as building permits, tax assessments, business license records, sales taxes as affected by retail sales, and mandatory increases in County government contributions to social security for its employees. The questions that are asked in this review are aimed at acquiring relevant financial information that will set the broad limits of budgetary possibilities. From a policy viewpoint, the basic question is whether current finances support the necessary budgetary outlays.

Throughout the Fiscal Year:

Funds can be transferred between departments within any fund.

Amendments to the budget requires Board Approval.

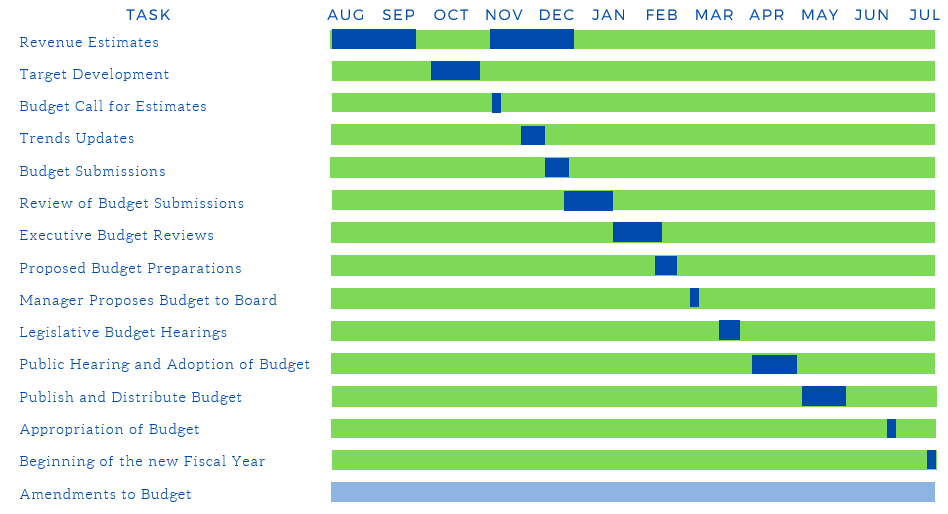

| Month | Activity |

|---|---|

| August/ September | Estimate of revenues begin |

| October | Target allocation set for each department |

| November | “Call for Estimates” allows departments to prepare their budget requests. |

| November/ December | Financial Trend Monitoring System Trends document updated. |

| December | Departments submit their budgets for review |

| January | The OMB reviews each department’s budget and makes recommendations to the County Manager. |

| February | Executive Review. Committee holds hearings to discuss budget submissions. The OMB finalizes recommendations. |

| March | Proposed Budget recommended to Board of Supervisors. |

| April | Budget Public Hearing. Annual Fiscal Plan adopted. Tax levies set for the next Calendar Year. |

| May | Annual Fiscal Plan – Compiled, Published, Distributed. |

| June | Funding appropriated for the next Annual Fiscal Plan. |

| July | The new fiscal year begins July 1. |